. . brings a decentralized and democratic economic platform to the real economy! . . brings a decentralized and democratic economic platform to the real economy! |

||||||

Cloud Capital Chamber of Economies Cloudfunding CloudfundMe Buyers Crowd Sellers P2P Groups Places SignUp |

||||||

|

||||||

| Localization verses Globalization l Disrupting everything Commerce l Price Demand l Sellers Will Always Sell for free l Global Freelancer Crowd | ||||||

| Cloudfunding to Scale Disrupting finance with free 'working capital' the Global Markets Vs Markets | ||||||

Equilibrium in Supply and Demand is hard to achieve, either the supply side has the greater advantage or the demand side has it! Local markets can continually swing from one side to the other, then there's the added issues of contending with trading partners in other countries who can be competing with the same issues in their markets - currency trading 'wars' and trade subsidies. In any market, the seller is usually the one that gives way to demand, if the seller wants to get the turnover needed to stay in business they inevitably use discounting as the means to getting a result. Losing the discount value is the short term fix to getting sales but if that discount lose was still able to be gained by the supply side while still giving the discount incentive to the demand side - there would be a closer equilibrium in the market. Equilibrium is generally when a price is found to be acceptable by enough buyers to satisfy the seller, sufficient to cover overheads and make a profit, and continue to invest in growth. But with continual heavy discounting in small local markets there can be long term effects, like prolonged recessions and falling revenues, not just for the businesses but for the local and broader economy. eQconomy's economic model using advanced pricing, provides the advantage for both the supply side with full selling prices, and the demand side with incentives of deep discounts and Free Economic Value for buyers and sellers, gets the equilibrium balance needed. With the Digital Free Trade and Commerce platform, each end of a single product sale in a local market and at each end of a cross border trade in the Global Markets are all in sync, with both Supply and Demand getting an advantage. The Platform has a fully autonomous SaaS architecture that's structured to form the ComTechX industry - it adds the incentives for the Global Crowd to be involved in expanding the decentralized structure. |

|

|||||

|

||||||

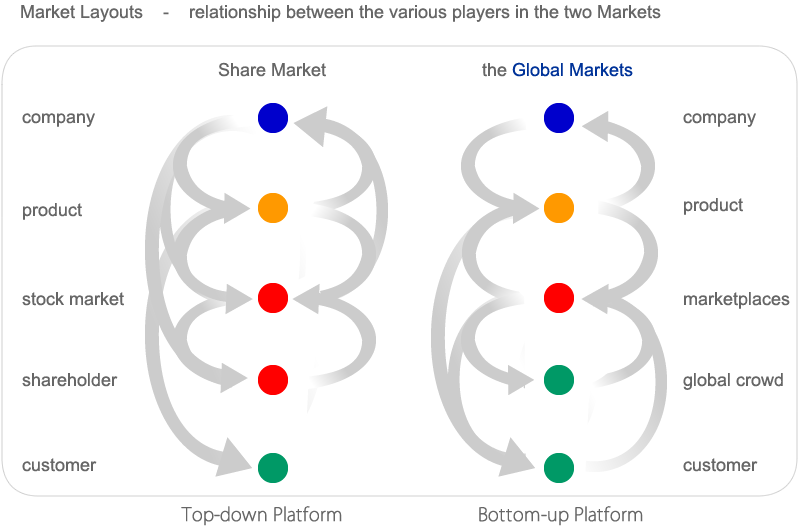

Pricing of products and services within an affordable range is what expands productivity. The world's pricing structure for goods and service' is dictated by the Commodity markets around the world, they've been instrumental in providing a balanced universal order of pricing that flows down to countries and industries before reaching the people. This universal order generated through the Commodity markets is to 'find' the balance between supply and demand for goods in each country and region by fitting within the affordability, down at the people's level. The supply side means that whatever price that can be extracted by suppliers, the better chances of finding buyers on the demand side further down the supply chain. Finding that balance is key to having the free markets work out the fair price range, the difficulty of this method or theory is that within countries and regions there's another mechanism that's added to give help locally, in subsidies and taxes, that can distort things. The change to the flow of capital and growth, that's evident in the recent study, is when one side gets the upper hand and takes advantage of the other, this is the case with Share Markets having the tools to 'spin' the future positions of companies in where they might be, in predicting future market trends by using past data. Share Markets today now work more for their own main players than ever before, namely market makers and shareholders, shareholders have become the main audience that markets listen to, some would say the only thing, rather than the overall consequences. There is a vast difference between a Free Market and one that's able to roam freely - free to swing wildly with prices that have lost 'connection' with the everyday person, paying forever increasing prices. With technology speeding up trading over the last decade it has caught out the markets and their ability to keep trading 'open'. The complexities of how markets work and why they don't work in the way they are suppose to balance supply and demand, has probably opened up the next era of how supply and demand needs to operate in the digital era. The change of how markets will work comes with the change to how influence and value can cross borders to stimulate local economies by the initial actions of local Sellers applying free Direct Foreign Decentralized Capital - DFDC does the rest. All boats need to rise! Placing the emphasis on the individual person rather than further up the market flow, gives the Global Markets a substantially different flow of value than how Share Markets operate. With the individual having the option to actively participate in generating productivity around the world in real time brings everything forward. Having a Digital Commerce Monetization System that distributes Free Economic Value to the the global population provides the incentive to generate unlimited demand for productivity around the world. The productivity being played out in real time is able to transfer value through the Global Markets to all the connected players - this differs greatly to the way Share Markets work when trading happens, the Share Markets way of operating dictates the price for the next trad', and not reflect 'the current trade' as the Global Markets does. Each stage of the productivity process from the instigation of a seller listing a product or service to the final exchange of payment in a fiat currency at a brick and mortar store, remains in the environment on the Digital Free Trade and Commerce platform. Markets that control world prices can be disrupted with commodities like petrol / gasoline, which directly and indirectly affects the majority of people everywhere - there are few commodities that can't be digitally connected to the Platform, which become manufactured products somewhere along the Supply Chain. The real time effect on the eQconomy platform allows the 'productivity' value to be processed in real time, increasing additional digital trading currency to all active locations, and from those locations anyone can build a Portfolio of Location Tokens that increase in value with every product and service sold. With every 'productivity action' having only a positive result, the volume of demand is a key to how much will flow to local economies. This real time increase to the volume of the digital cash trading currency has a profound effect on the local economies where the Customers and Companies reside, with the value being immediately available to spend or use however the players want. eQconomy gives a more balanced distribution of global trade growth by restructuring how markets operate across commodities, currencies, companies and marketplaces - so the individual is not left behind. The connection between an individual with the digital era can only come about by the individual having an Identity, a Digital ID - with that ID a person will be able to have their credentials digitally networked across the world - this Digital ID will carry a person's Global side but also hold their Internet currency value, which UDC and Cloudfunds can be of significant importance because of the way these two currencies are generated and validated away from fiat currencies and credit value operating in other different financial systems - it will bypass the immediate environment where a person lives and allow them to be connected digitally, giving them the freedom of being able to interact with people and businesses and to exchange a payment so simply without involving the incumbents that currently exist. The chance of being born in a society that is off the grid is how life can be for many, so it's up to others to make sure there is a level playing field for everyone, this is what eQconomy set out to solve, to give isolated regions the chance to 'tap into the grid' now that technology and communication has provided the means. With UDC, the trading currency that's used to exchange products and services, just as fiat currencies do in local regions, isn't enough to progress at the pace needed to correct some the issues being confronted, there's a need for a better financing system that can influence productivity on a global scale - that influence is Cloudfunds, it's a free working capital currency that's earned and used for free and never needs to be paid back. The RunWay we're now on is long and involves enormous challenges, we know of major demographic shifts that'll place huge pressure on the current and next generations - so to have a back-up plan that the people can have some control over their lives isn't beyond or down the road - it's here now! |

||||||

Here's how Outsourcing works and how it disrupts? Outsourcing is primarily finding cheaper Labour Market to manufacture a product or supply a service somewhere else other than the location of the buyer, there is a payment to that location for that Labour Market and payment to each seller along the supply chain using various payment transfers, until the full price is added to the product for local buyers to pay - each action along the process adds costs and margins to the final buyer's full price - the transfer of payments between countries ties in with trade surpluses and deficits, and foreign currency exchanges - ultimately effecting domestic costs to consumers with the added incumbent costs incurred along the supply chain - it shifts productivity and its wealth benefits away from the final buyers location to the offshore location eQconomy outsources the selling of products and services listed by sellers at full selling prices, the product or service is produced in or sold from the location of the seller at local costs - algorithms using a selling mechanism collect the full price and costs using a global digital trading currency, it involves market makers who compete to win items that are set at a maximum 20% of the full price, the collected seller's full price is escrowed away until the exchange with a buyer - with the full selling price already secured away, the disruption comes when the item is released to local buyers at the same maximum 20% price as the winning virtual wholesaler - the exchange of item between a seller and a buyer releases the payment that's been held in escrow, to sellers and virtual wholesaler' - the payments collected and released to each party do not involve foreign exchange of currencies, therefore adds value directly into the seller's economy |

||||||

Check out a Deal Registration and Cloudfund Strategy See a Snap-Shot view of a Cloudfund strategy and bidding for Deals Cloudfunding generates Price Demand - digitizes 'cash' to flow ubiquitously around the world What's The Monetizing Moment? Cloud Commerce operates by Outsourcing the Selling to the Crowd by Cloudfunding How Sellers Outsource their Selling to the Crowd? |

||||||

|

||||||

| About Us Contact Privacy Policy Terms of Service |

||||||