. . brings a decentralized and democratic economic platform to the real economy! . . brings a decentralized and democratic economic platform to the real economy! |

||||||

Cloud Capital Chamber of Economies Cloudfunding CloudfundMe Buyers Crowd Sellers P2P Groups Places SignUp |

||||||

|

||||||

|

||||||

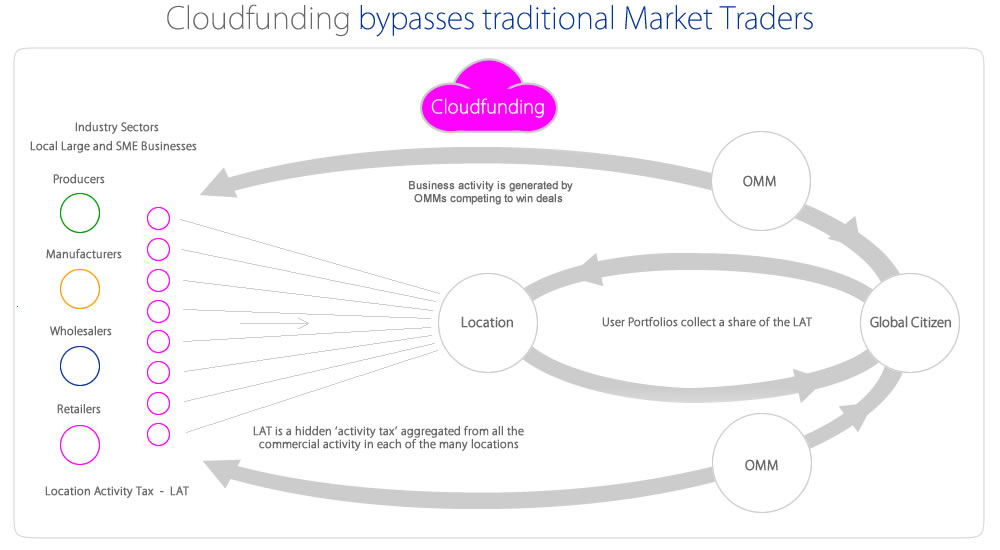

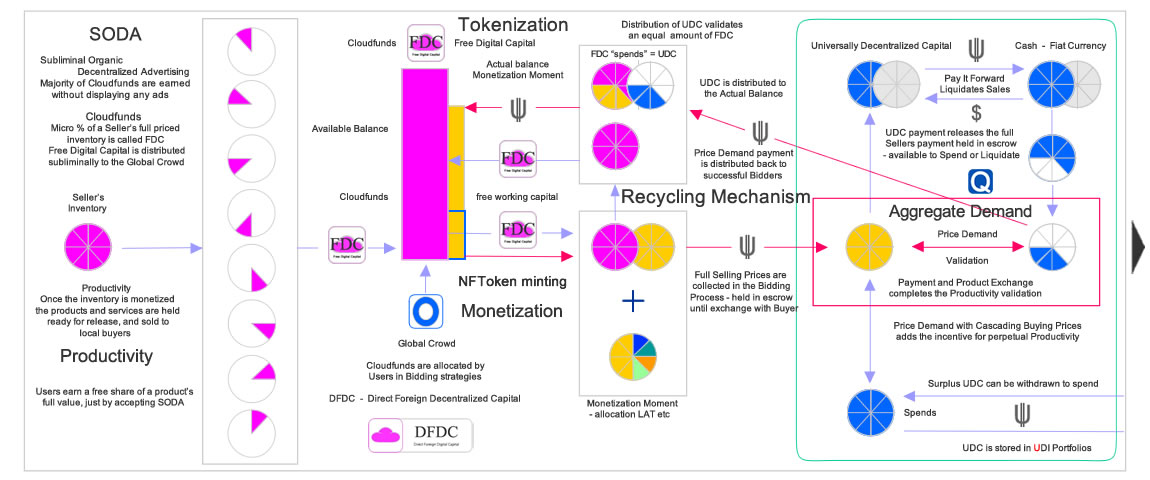

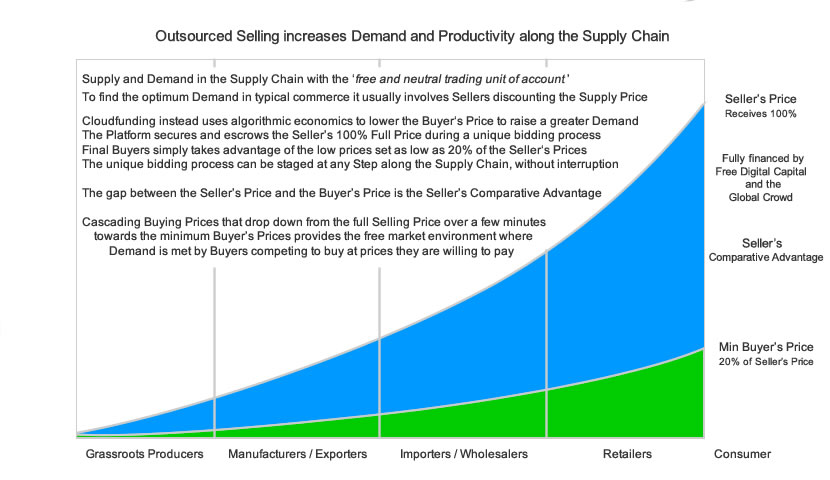

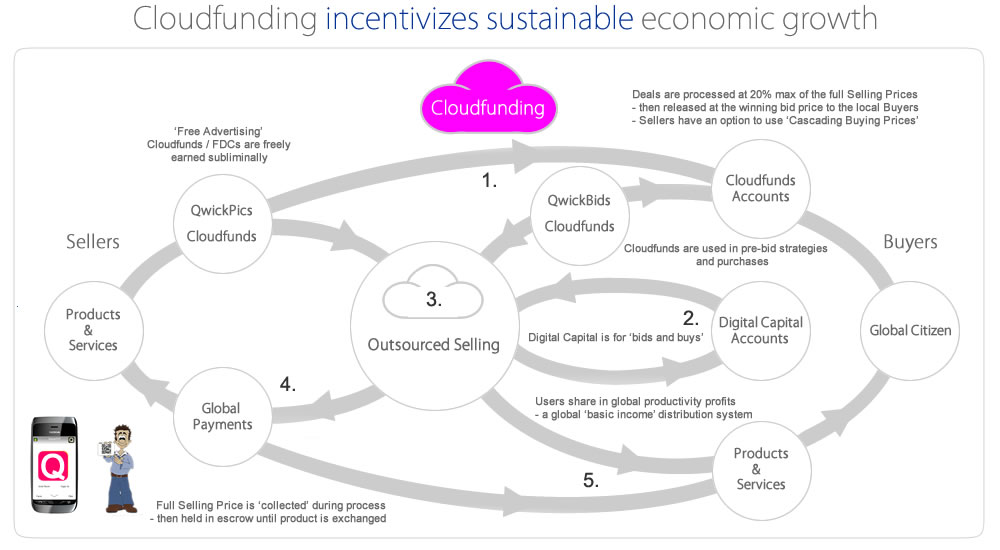

Everything needs to change over time for all types of reasons, commodity markets are no different. For several hundred years markets have operated with a downward price control that results in whatever the agreed prices at the global trading level, that's what flows all the way down to the origins of products. When global trading markets first began there was never any contact between the producers and the next suppliers in the supply chain, and even if there was it did no good because the pricing was already set or conjured up, regardless if it was a fair price. Modern markets still continue in the same way with a top down structure that seems to ignore the change that modern business is more complex in its infrastructure and operating costs, with many sellers not able withstand price fluctuations - prices are mostly based around trading margins and future trades rather than sustainability of the market suppliers. Changing the dynamics of trade Cloudfunding provides the Platform for market prices to be influenced and set by the Suppliers and Producers in the Supply Chains at sustainable and profitable prices - the pricing dynamics move along the Supply Chain flowing from one supply stage to the next. Cloudfunding changes the market pricing dynamics by being financially sustainable for the Producers and Suppliers so they can continue to trade with full profit margins - Cloudfunding provides Producers with higher pricing that's based around the quantities and the capacity to produce, with the foundation built on sustainable economics and where Localization takes root. What is changed is how the pricing is controlled by the Sellers with the help of a network of market makers that operate just like traditional traders and wholesalers that compete to win product deals listed by suppliers - pricing is structured on local operating costs and automatically uses factors that adjust to costs instead of being dictated by manual profiteers further up the chain. This virtual wholesaler in the Supply Chain is the Open Market Makers - OMMs, these are ordinary citizens who by operating as a part time or full time business, ubiquitously influence the financing and selling of products and services around the world. The Global Digital Markets operates with the Global Pricing Index which tracks location by location prices to give Sellers real time price changes, Sellers control their Selling Prices, with the GPI providing the guide to what the market can handle - listed Selling Pricing settle at or above industry accepted prices to provide growth margins that gets supported by a Scalable New Economy. The location of the productivity is elevated onto a global stage where the OMMs directly monetize the Sellers with a scalable and global DFDC - Direct Foreign Decentralized Capital to support the pricing through Outsourced Selling - it bypasses the global market traders by having higher selling prices and lower buying prices that the local supply traders have trouble ignoring. Structured within the Outsourced Selling mechanics is a Location Activity Tax that has an on-flowing effect with the distribution of wealth based on real genuine global productivity and directed specifically to the broader number of individual Users - this differs from the limitations that global market trading has on economies where wealth ( profit ) distribution is confined to only those involved as market traders looking for kick-backs via short term trading and dividends. Cloudfunding has a structure with a foundation built around quantum economics where value is accountable and productivity wealth is reflected in real time, in the future, markets will need to perform in real time and that means the capabilities of quantum computing is paramount. Modern business is more complex, operating infrastructure and financing can bounce suppliers from pillar to post by following a so called free market system, the fact is, very few are free markets if any supplier in the chain receives a concession or benefit through a government kick-back, then it's not a free market, neither is when tariffs are placed on imported goods or currency wars influence lives along the Supply Chains. |

||||||

| . . the old economy is cyclical and structured on 'boom and bust' speculation - the new digital economy is structured to be scalable and equitable | ||||||

|

||||||

|

||||||

Every product and service can now get a Comparative Advantage in a scalable Digital Economy using the GOMTX - anything produced, manufactured and retailed along the Supply Chain, from any Industry, from any location in the world, - any SME or industry leader can use Outsourced Selling in the Digital Markets to jump clear of the competition - for free. - 'Outsourced Selling' finds a winning formula for Buyers and Sellers, that flows on giving local markets an economical boost - it makes advertising free, reinventing it as Free Economic Value for buyers and sellers to earn and use as working capital - free advertising breaks free of CTR ( click thru rate ) and in-view rate formats, it instead delivers sellers guaranteed sales - a ubiquitous global P2P payment system tracks Ownership exchanges of a neutral digital trading cash in all trade, for free Small and Medium-sized Enterprises will become the economic powerhouses needed for the 21st Century. |

||||||

|

||||||

| Producers / Growers / Parts Manufacturers | Manufacturers / Processors | Retailers / Dealers | ||||

|

|

|

||||

The Global Digital Markets can't be over-hyped by the hearsay of some change in the political arena, it only reacts to Productivity in real time, which can neither cause inflation or deflation, if there's simply no productivity trades, then everything remains stable. it doesn't follow the traditional Markets controlled by tiers of incumbents that specialize in speculating and controlling global commodity prices, oblivious to the livelihoods effected along the Supply Chains. - the Global Digital Markets ignores that legacy model and starts operating from the initial seller in the Supply Chain, building out a bottom-up economy that doesn't forget the person who puts it all on the line to supply the world. - the Global Digital Markets brings together the various segments of the Scalable Digital Economy, such as the On-Demand, the Sharing and Peer to Peer economies, where all the players can co-exist and grow on the one level using the same tools and economic values. The Global Digital Markets sets it's own path, incorporating Free Economic Value, a digital cash trading currency, a free global payment system and a wealth distribution network, which together solves a global issue. |

||||||

Global Distribution Users enter the Global Digital Markets in the local level of commerce at brick and mortar stores, where it ensures that the fiat currencies remain in the local economies to continue to circulate - the Global Digital Markets or the Platform doesn't hold any monies, it holds only the records of ownerships of the Location Units and value Location Tokens have unlimited Units that can be bought and sold by anyone from anywhere - Units are held in User Portfolios - the commerce interaction between buyers and sellers at the local level via productivity, continually validates those values, globally Any User can freely buy and sell Units in any location, including where they reside, - it provides an open transparent 'free market' structure that's the foundation in forming the Global Digital Markets - that operates along the Supply Chains within the overall Global Digital Free Trade and Commerce platform - the commerce activity in each location around the world, continually gets updated with each location's earnings in real time - for each commerce action there's a LAT ( Location Activity Tax - Global Wealth Tax ) debited as part of the distributed revenue - this revenue is distributed globally to every Location's 'Unit' held in the various User Portfolios, in real time. The User Portfolio is the Digital Era's version of the Bank Account - where Users hold, spend and strategize with their wealth. That wealth is spendable globally, without fees or exchange costs - it finally makes remittances a natural part of the free market. |

||||||

| About Us Contact Privacy Policy Terms of Service |

||||||