. . brings a decentralized and democratic economic platform to the real economy!

. . brings a decentralized and democratic economic platform to the real economy!

Realty Demand has the platform for sellers to sell new and existing houses at the full selling prices, guaranteed!

Listing inventory to outsource the selling is free of fees and even payments of the full selling prices are free of fees and charges.

Houses and property have always been sold either with buyers making offers until a vendor accepts the price, and running an auction where buyers bid higher prices until the vendor accepts - Realty Demand uses Cloudfunding to fully monetize the vendor's full selling price with the global crowd, who compete to earn a share of the final buying price of the house or property.

Commerce has changed, it's no longer about discounting supply until there's a demand - it's now all about real-time price demand!

Want to buy a house?

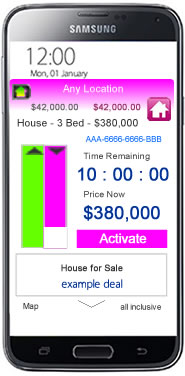

Realty Demand offers buyers Price Demand, where the full selling prices begin to cascade down when a potential buyer decides to click the Activate button - once that happens, notifications are sent out to other local users who showed interest in the property - then it comes down to who hits the Buy Now button first and pays what they want to pay as the buying prices cascades down to 20% of the full selling prices ( without it affecting the seller's full selling prices ).

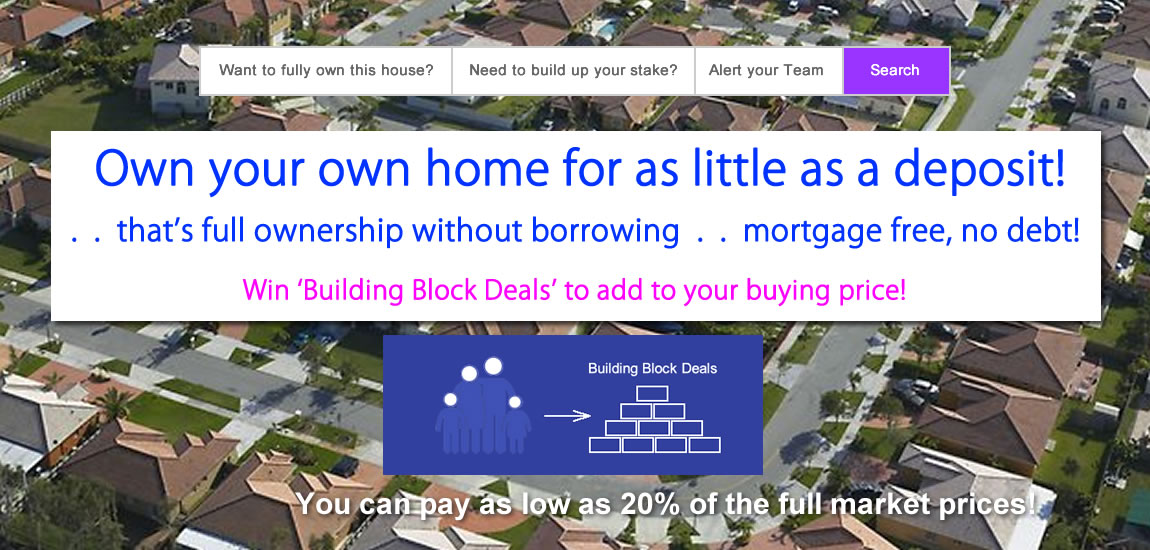

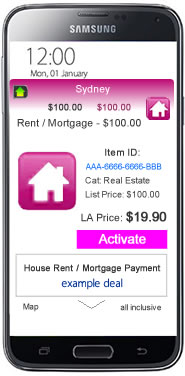

Buyers need to fund their accounts to activate Price Demand, opening the way for sellers to liquidate their sales - and for users to avoid missing out on great deals there are plenty of Building Block Deals to compete for - users can also earn a share of the many deals' final buying price by being an OMM - even take advantage of the Affordable Rental / Mortgage Payments to help ease the cost of living.

Any user can download the QwickPic Ready App to automatically collect Free Economic Value and use it globally as free working capital to help earn a share of the aggregate demand payments from buyers purchasing deals - and be ready to use the extra funds in real-time online cash commerce to buy products and services with Price Demand - the day of paying full price is gone!

How It Works: Cloudfunding changes the dynamics in how real estate can be sold and bought - houses and apartments are listed at the full market selling prices in an outsourced selling process that monetizes the full selling prices with the help of a global network of market makers - from this monetizing stage the properties are released to the seller's local buyers who have access to Price Demand, which any interested buyer can Activate and buy at a price they want to pay as the buying price cascades down to 20% of the full selling price - interested buyers can compete as OMMs - Open Market Makers to gain a share of the final buying prices of any deal they help to monetize - any user can compete to buy Building Block Deals at below the full selling prices to help build up a stake to use when trying to buy a property or big ticket items.

| See how to win Building Block Deals |

Buy a Rent or Mortgage Payment

Beware of other Buyers

Cloudfunding breaks the cost of real estate down to affordable 'bite size values', and changes the process of buying a house by directly monetizing the full selling prices of real estate from the economic value drawn from the Productivity inventory sitting in local economies, with no over-hanging debt.

Realty Demand uses Cloudfunding, which ties genuine Productivity with a universal economic value that's tracked and validated as it flows between local economies monetizing the full selling prices of real estate, and products and services.

Realty Demand Building Blocks are a consumer spending Smart Contract that can be collected and stored for when a suitable property comes on the market and listed for sale on Realty Demand in the location and with the features.

This means that as a property is listed to outsource the selling ( just like all other products and services ) and because the value of real estate is a higher than general products and services the overall full selling prices ( including the associated costs ) is broken down to smaller Building Blocks, so collectively the full selling price of the property is still fully monetized.

With the property's full selling price fully monetized through the processing of the Building Blocks, once this is completed the property is released to interested buyers - this is where collected Building Blocks can be used in the buying price

Early birds can get a head start

Anyone who participates in the bidding process ( Outsourced Selling Engine ) of the Building Blocks and wins any of the deals can keep the Building Block and use it either for the same property or any other property released for sale - if any winner of the Building Blocks decides to pass the deal in and take the bonus value, those Building Blocks are then released to the open market at the full selling prices ( that range from $100 up to $10,000 ), with Price Demand.

Buyers then compete to purchase the Building Blocks and pay the price they want to pay as the buying prices cascade down to at least 20% of the full value - winning buyers can then use the Building Blocks ( full value ) whenever they compete to buy the property or even when other properties come onto the market - all property sales use Price Demand and the cascading buying prices, so competing for Building Blocks prior to a property coming onto the market can save a lot more than just the lower cascading prices.

Smart Contracts

The Smart Contract Building Blocks have values ranging from $100 to $10,000 which are generated by the Cloudfunding platform using free working capital that the global crowd collects - the decentralized economic value behind the working capital monetizes the Smart Contracts using the verified economic value from local economies and directs it specifically to a Smart Contract Building Block.

Building Blocks can be held by winning users of the Outsourced Selling bidding process and use it when they have property they are interested in buying is listed in their location - or the Smart Contract is released as a generic Smart Contract Building Block ( for any property ) to users on a national level via Price Demand ( again the cascading buying prices will find the prices users want to pay ).

Full selling prices including peripheral costs

When a property is listed on Realty Demand, it's listed at the full selling price ( based on local market trends and the platform's tracking GPI - Global Price Index ) with the associated property and sales taxes based on location and various costs usually paid by the vendor or buyer - there's no marketing, or listing costs or commissions involved to real estate agents - the agent's position is taken up by a 'new agent' who can be selected by the vendor based on their credentials and history, to look after advice on the preparation of the property and any relevant local pre and post sale tasks.

The new agent's fee is 2.5% of the selling price ( fee is not added to selling prices but included in the Outsourced Selling process ) and is structured as a Smart Contract and purchased by the vendor ( using Price Demand - with the value held in escrow ), between the listing of the property and prior to the commencement of the Outsourced Selling bidding process - when Price Demand finds the final property buyer, the agent's Smart Contract value, purchased by the vendor, is released back to the vendor and the agent's fee held in escrow is released to the agent on the completion of the sale.

Country:

Region/State:

City/Suburb:

Category:

Sub Category:

Title:

Currency:

Price Range:

Property prices are structured with a benchmark price that's based on market trends and time frames that hold a price near the top of the market - this means that when prices have peaked in the local market, Realty Demand prices hold firm while the credit cycle typically drops the market prices with the loses taken by those having the mortgage - whenever and if market prices return and move up above the held Realty Demand prices, the new Realty Demand prices will follow the upward trend.

Debt created in Real Estate by Credit is deleveraged by validated economic value

The reason that Reality Demand prices are independent of market trends, which can rise and fall mainly due to the availability of credit, is that when rising market prices are paid out using credit, then that volume of Capital is released into the general market that influences prices - so when Cloudfunding uses that top end property value as the purchasing value, it actually corresponds it to genuine accountable economic value that's tied back to real Productivity in local economies.

Because the loan value has already been added to the banking system's money supply market, then that value, even though it was created as credit, it can be substituted ( bought out ) with genuine value that's accountable and traceable down to 14 decimal points across the Cloudfunding platform ( effectively genuine value validated from Productivity in local economies ) - this helps maintain prices on the high side of the market trends without following the markets down when a bust hits - it leaves borrowers without the debt hanging over their heads if prices fall below their outstanding debt to the lender when Realty Demand is used to sell or pay down a loan with Building Blocks.

The Realty Price Demand works the same as other product and service deals, with the exception that the Building Block Smart Contracts can be added to the buying price when trying to buy a property.

Cloudfunding uses collaboration

The way Cloudfunding's economic model is structured doesn't involve debt - any sort of wealth and good living standards can't be gained if there's an increasing pressure from debt - with Cloudfunding constantly tied and governed by genuine Productivity that's produced, manufactured then sold in local economies, no debt can be accumulated by anyone - what Cloudfunding does is it operates on a global scale using the real time economic value from the Productivity sitting in those local economies around the world, all collaborating democratically to achieve wealth for their communities, as part of the Global Chamber of Economies.

A new economic model offers home ownership without the debt

There's no doubt the world is moving through a transition from the old economy to the new digital economy where everything is computerized and being run by algorithms and software.

Now is a time where the world has started to realize that the economic models that have spread across the world, particularly in the past four decades with the escalation of converging credit and debt with real estate to create the wealth effect within countries is increasing a burden of debt on society that is getting heavier to carry.

It's a natural thing that real estate is the most sort after single asset that individuals see as their measurement of wealth - but they're now constantly sitting on the precipice, ready for it to all fall over - not necessarily on the wealth they can lose when real estate prices go down but the amount of debt that still remains.

It all hinges on a small group in the middle who try to read the future by looking at past data - and from a central position, make judgment calls on raising or lowering interest rates on credit that individuals borrow from lenders - those changes can raise or lower demand for credit and ultimately raise or lower the value of the home prices, causing the booms and busts

- this central control using rates is starting to look like using a rowing oar to steer a container ship in today's faster world that's taken on $US250 trillion in global debt, which is more than three times the size of the total global GDP.

Many have come to understand the inner workings of the financial system, and how credit is created first out of thin air, then securitized with the very product that is being purchased to back the debt - this form of credit creation formed much of the problem behind the GFC - now, even with some slight changes, it's back again but building out to be much bigger by allowing easy credit to drive house prices up to unaffordable levels and forcing the private sector to carry the indebtedness.

Cloudfunding reverses the dynamics

ComTech is a new industry, which merges commerce and technology to bring Cloudfunding to real estate, changing the way houses and all types of real estate are bought and sold - without the over-hanging debt through borrowing, and constantly waiting for the shocks to come.

Instead of credit creation being the leading mechanism before there's any Productivity, Cloudfunding leads with Productivity - this change of positions takes on a whole new paradigm with the way houses, and in fact, anything can be bought and sold.

A change to full ownership without credit and debt

Borrowing and having a mortgage is counter-productive as it leaves the borrower with less disposable income that could be spent on consumer spending - the only thing that can overcome this negative issue is for prices to continually increase, creating the wealth effect, and again it carries a debt

The wealth effect is mostly an expensive model when one loan is created to pay out an existing loan that hopefully inflates the value - true it's not always equal value but only a small proportion may be seen as producing any real value, and most is not regarded as having any value adding to productivity at all - it's more about selling a financial product by creating credit today with the hope of generating productivity in the future.

Even new house construction has two sides, one is that all the Labour Market and materials used to build are on the productive side with supplies and wages generated as consumer spending but it equally locks down the borrower so they have less disposable income for years that will never get back into the flow of consumer spending - productivity around new construction more or less has a sugar-high effect in the short term but there's an increasing burden, as more of the same in more mortgages is needed to replace those already indebted for the long term

It's the economic value not the money that changes things

This compares differently to the way the financial systems work when creating credit, which is debt - this debt is loaned out to people who want to borrow to buy out a property from someone else who already owns ( or borrowed against ) the house or maybe built the house - the new borrower may have the house or apartment to live in but the financial institution most likely owns the majority of the value.

Overall the money created to buy the house or apartment doesn't do much for the local economy because it may pay out another loan owed by someone else ( the seller ) or in the case of a new house the money would go back to pay suppliers and wages but there's still a debt and interest owed that's drawn against future productivity - it all rests on the hope that the value of the properties go up in price and the extra value variation comes back in the future in consumer expenditure in local economies.

Cloudfunding doesn't create money, it digitally aligns with local currencies already in local economies and perpetually redistributes the economic value using technology that stimulates the flow of Capital through better economics, via a decentralized and democratic consensus using Productivity as the leading catalyst - with the end focus of increasing the economic growth in those local economies.

Cloudfunding operates in todays' reality

Cloudfunding operates using genuine Productivity that's validated with real time consumer spending,

with fully purchased products and services ( again no credit is used ) constantly tracked, which is commercially sold in local economies regionally, nationally and globally - no future Productivity is jeopardized to cover any debt - the key of not creating future debt is to have wealth generated by true value today, not create the effect of wealth.

When a seller lists a house, apartment or any type of property by outsourcing the selling it and all the costs associated is fully monetized from verified consumer spending that has occurred in the connected local Chamber of Economies - the significance is that the products and services sold gained the full selling prices while the buyer paid whatever they felt was affordable to them.

It's widely understood how online digital advertising can spread beyond any previous form of distribution - Cloudfunding takes that distribution digital phenomenon, and changes how capital flows throughout the world economies so that all types of products and services, including real estate, can be fully monetized even before finding a buyer.

It's the way in which deep tracking of data is now able do more than just having a middle man making judgment calls when it comes to who can borrow credit - Cloudfunding treats everyone as an equal by monetizing with Direct Foreign Decentralized Capital - DFDC into local economies using a decentralized global consensus.

With Cloudfunding using productivity as the leading catalyst, it opens up new capital flows that can be distributed through a subliminal channel into the hands of global users as part of a global financial inclusion focus - this wide distribution process takes all the noise and creepiness that has become so annoying across the internet, to an Opt-In process that reverses the role played by users from being the product to being a beneficiary of new capital that can help drive local economies and bring wealth to individuals.

It's this distribution of new free capital that taps into an unlimited resource that has previously gone untouched but now through technology is able to be distributed to a wide range of users that are a neutral decentralized global community who all have varying wealth levels - they bring together a global consensus that's democratically accountable and are free to be involved in helping to drive productivity in their own local economies and benefit from helping to directly drive productivity in foreign economies.

The economic infrastructure behind Cloudfunding that generates the new capital flows, provides an international unit of account that can be tracked in real time and be seamless and ubiquitous, while constantly being fully tied to real world values - this gives the new capital a genuine role of being a native and neutral universally distributed trading capital of the internet to exchange from peer to peer wherever users are located throughout the world.

The true demand that comes from the real time use of the cascading buying prices with Price Demand as compared to sellers trying to find a demand by discounting, has a more genuine value of the demand for such products and services in a local economy - the buying prices paid with Price Demand are distributed immediately out into the hands of users who are incentivized to help drive the local economies - this mechanism avoids the slow flow of capital that the financial systems cause in local economies

Full ownership with as little as a deposit

The change of being able to fully monetize a house, then release it to buyers with Price Demand, which starts the buying prices cascading down to just 20% of the full market prices - is what makes the paradigm shift in capital flows in local economies so crucial to future generations that can gain ownership without the debt hanging over their heads.

Cloudfunding changes the landscape of real estate with new and existing homes and apartments, by being able to sell and purchase using a different formula - instead of having the issues with having an existing home and needing to sell it before buying another, Cloudfunding opens up the options of being able to buy into a new home before needing to sell the existing one - if a new house is purchased using Cloudfunding then the old home can be listed after with Realty Demand to sell at the full market price, without the stress of a quick change over and the extra costs.

To give buyers the chance to buy full ownership of a home with as much as what they would need as a deposit if they had to borrow to purchase, brings a deleveraging tool to a new generation of buyers that can change the status quo in real estate ownership.

Debt free ownership means more spending

The freedom of having full ownership without worrying about mortgage payments changes the flow of Capital in the local economies with the increased volume of deposable incomes that can be spent at local businesses - local economies only survive when local buyers spend their incomes on products and services - and this is where the infinite flow continues with sellers using Cloudfunding to outsource the selling to get their full profits while giving buyers the chance to buy with Price Demand.

The Price Demand buying prices immediately go back to validate more working capital, which continues the infinite spending cycle - making it something more beneficial to the local economies than the credit cycle - these economic values on local economies are the new Capital flows that are constantly tied to the real Productivity, and are algorithmically motivated to find affordable financial solutions for users in their local economies, on a global scale - the local economies' economic values are generated by consumer spending habits, and are part of the essential formula needed for sustainable Productivity

New economic 'building blocks' under-pin local real estate values

Cloudfunding operates with an economic infrastructure that allows market dynamics to perform autonomously compared to other markets that are driven more by the financial industry.

- it means Cloudfunding can maintain the high market prices for Real Estate independently during any down-turn, allowing buying and selling to continue based on the full market prices that is under-pinned within each local market because of its link to true productivity values back in the local economies.

- this is regardless of the general markets that can fall due to any number of market forces ( mainly from the lack of credit and the build up of too much debt ) - Cloudfunding sets a market high benchmark based on time and value to allow those buyers that may have bought at the high end of the market cycle have a soft transition out of the speculative markets and into a stable market that's based on capital that has circulated through a true productivity cycle - effectively, maintaining the higher benchmark prices helps to soften the impact that a property bust has on local economies that go through the credit cycle.

- importantly it means whenever there's an upward increase in market prices that the Global Chamber of Economies tracks and maintains for the local ( Chamber of Economies ) market prices via the GPI ( Global Price Index ), it follows any new price increase in the general local market ( that moves above the local local CoE market prices ), and gives owners a major benefit of their investment.

Contact

Privacy Policy

Terms of Service