. . decentralizing new Capital flows in the digital age

. . decentralizing new Capital flows in the digital ageDeCom Markets FOMEZ GPEUN Queen Bee DOMIndex Economic Engine FEV Smart Contracts UDC DFDC UDI PriceDemand Cloudfunding Main St

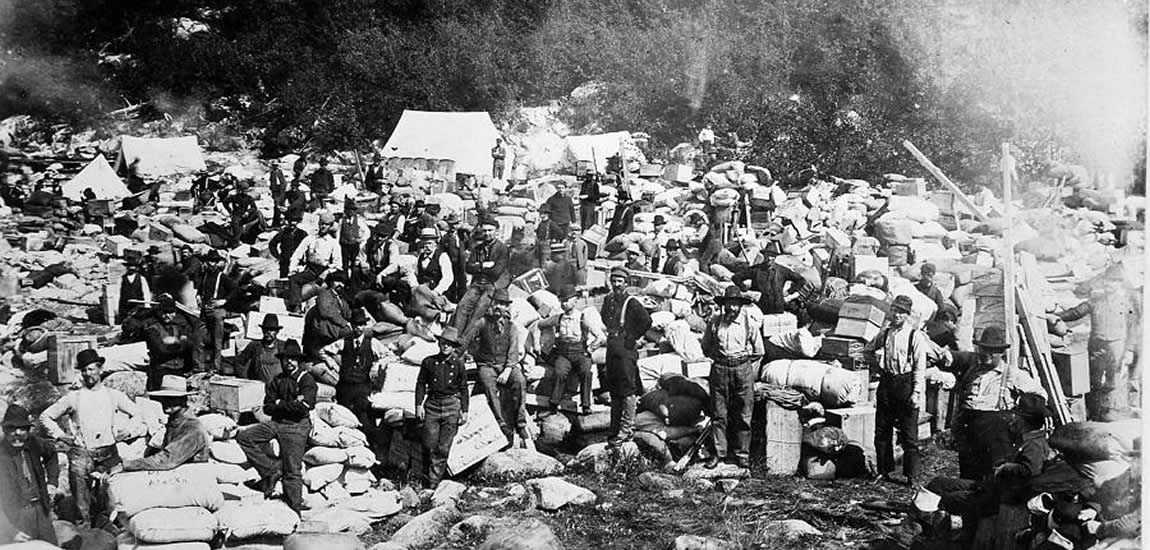

Often merchants exchanged products and services for the miner's gold . . making gold the 'means of exchange'

Where's today's Gold?

It's in the economy, . . where it's always been!

Gold is no longer feasible to use as a 'means of exchange'

. . but the 'economic value' of a merchant's inventory is as valuable today as a means of exchange, as it was back then

Today's 'gold' is the 'economic value' of a merchant's inventory!

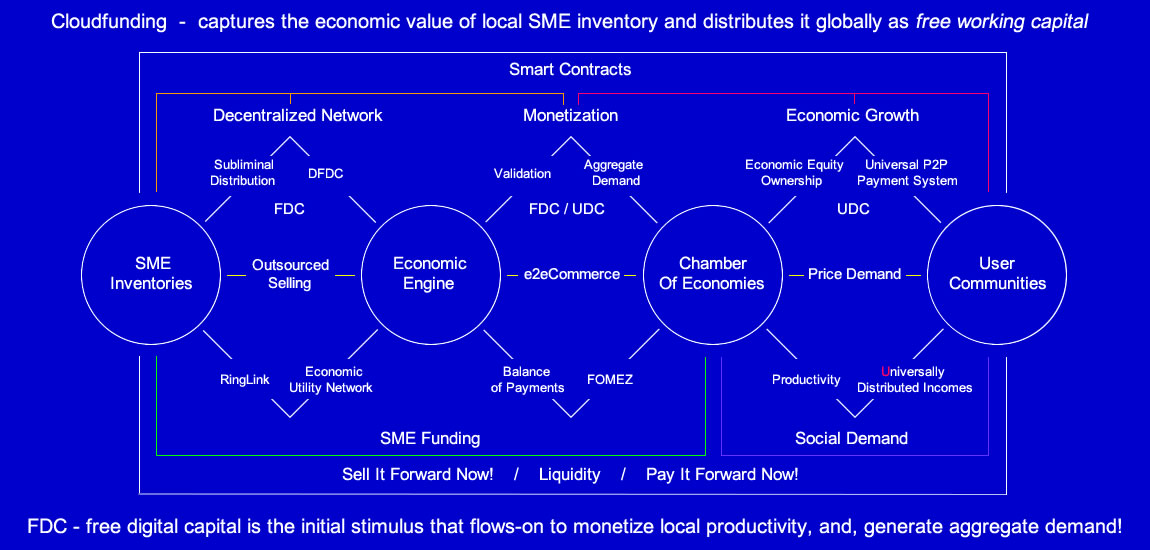

While merchant inventories 'sit idle' waiting to be sold, its economic value can be distributed globally as a means of exchange

The full selling price value of merchant inventories is freely distributed in micro-values out to global users ( miners / market makers ) to use as free working capital

. . read more

Users collect the free capital to use as working capital to help monetize and validate the means of exchange to send and spend

The distribution of free working capital provides a new avenue for capital to be validated and governed by true productivity that's controlled by society

. . read more

Economic equity stakeholders take on a proactive role by helping to drive productivity, and then share in the economic growth

Equity stakeholders have a genuine self-interest in ensuring economic growth by being directly involved in generating and driving capital into local economies

Every town and city has a local economy, now that true value generated through productivity is tokenized, so local economic growth can be globally shared

Why have a share in a company when you can have an equity stake in an economy!

. . read more

All the supplies needed to sustain the miners and support the surrounding communities would often be more valuable than the amount of gold being found, but from that chaotic foundation laid the early infrastructure to many of today's towns and cities.

What was typically seen in Main Street was supplies of products and services being held by merchants ready to be bought by the miners when they came to the store. This uniquely untapped time between when a merchant gets their supplies, and the time when a buyer comes and buys the goods, is the 'idle capacity' of the merchant inventories' economic value, just sitting idle in the local economy.

The longer the products or services took to be purchased the bigger the incremental lose to the merchant, and a slowing down of the velocity of the local money supply circulating around in the community - the faster that sales happen the faster the money circulates, with merchants earning profits that get spent locally, maybe on wages for workers to spend in the local economy, it all keeps things ticking along.

It started out as an opportunity for many merchants to fill the need of supplying products and services to those who wanted what was on offer - then as more competition came with more merchants there was an increasing need to get the attention of buyers. This is where shop front signage, the local newspaper and notice boards gained the eye of buyers with advertising what the merchant had to sell.

Fast forward to today where the 'idle capacity' in local economies is no different, there's a time period that's idle and the only way that changes is to advertise and or start discounting to grab the attention of buyers - both have costs for merchants, and the local economy.

Today's digital advertising with its algorithmic bidding, pay-per-click and user surveillance, is really only a continuation of the early newspaper model being used to attract attention of buyers - it's still only a one-sided model that's unaccountable when it comes to sales

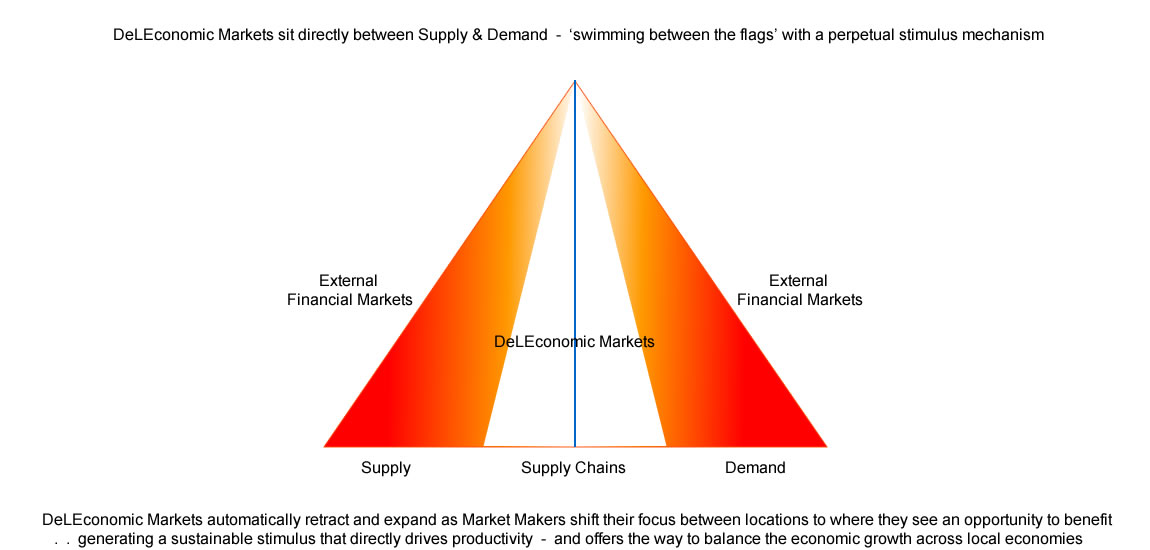

Decentralized Local Economic Markets - are designed to scale productivity

While the financial markets are built around selling money as its central product, which's loaned out to borrowers who pay interest during the time of its use, it's basic aim is to be productive and build economic wealth for its borrowers, and provide profit to the lenders - so why hasn't it worked to achieve the increased productivity, and why is all the debt now on the shoulders of borrowers?

Although money is created out of thin air, just for the purpose of lending, there's still a risk that there's no productive outcome from its use, and there's a possibility of failure to repay, even though it was created from nothing, but lenders have basically preferred to gain by speculating on asset prices where they can artificially control prices, instead of generating productivity - much of the blame can be narrowed down to the lack of interest by the lenders in helping SMEs in local economies.

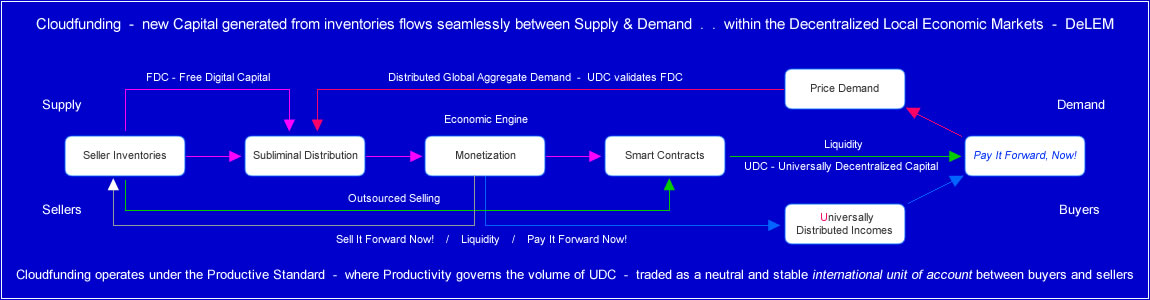

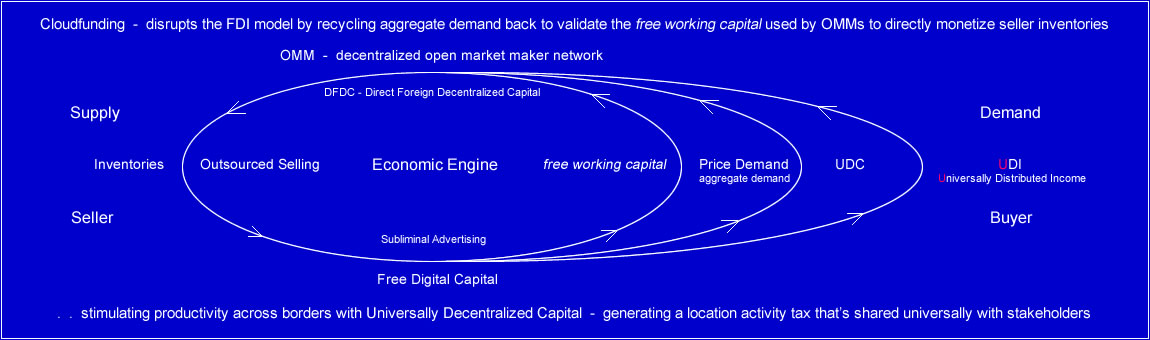

The decentralized local economic market is differently structured - it's aimed specifically at SMEs so they can be fully productive without using credit and debt but using what most SME have in huge amounts, their inventories and its economic value - and by tapping the economic value in the local inventories, and freely distributing that value in micro-values through subliminal advertising, it initiates new capital flows that's validated as universally distributed capital by the global aggregate demand ( real payments ).

DeCom Markets take over the void left open by the banking system that has consistently directed their lending capacity towards big business where they get bigger profits, and only pick small businesses that have external assets as collateral to lend to - DeCom Markets have Cloudfunding with the productive economic infrastructure similar to the Glass-Steagall Banking Act of 1933 where banking for productive purposes was separated from speculative investments - Cloudfunding provides the asset based architecture for productive purposes and the DeCom Markets provides the non-speculative system to still encourage businesses and users but without using credit and debt as the driving mechanism.

Local economies now have their own 'Gold Standard'

That universal capital is constantly tied and governed by the volume of productivity in product and service sales being produced across all local economies, globally - it's the Productive Standard, a modern day Gold Standard that uses the true economic value of all local economies, and through a recycling mechanism using the aggregate demand, it can both govern its volume, and validate it as a neutral universal economic capital that flows freely between local economies around the world to drive a continual stimulus into local productivity - Cloudfunding's structure is similar to the original Gold Standard and the 1944 Bretton Woods System where the US Dollar was backed by Gold, but instead of Gold, real time Productivity is the new governing mechanism and intrinsic backing for the neutral universal economic capital.

The economic value isn't something that's pulled out of thin air, it can be seen in every shop window, sitting on shelves, and in factories and warehouses, it's all the 'idle capacity' in local inventory waiting to be sold - this is supply looking for demand - what decentralized local economic markets do is take those products and services, and distributes the full selling prices of each unit in the inventories ready for sale ( potential productivity ) out to global users in micro-values as free working capital via an outsourced selling process that uses subliminal advertising to gain exponential distribution - and through deep tracking and a recycling mechanism the aggregate demand of global productivity is captured and directed back to fully monetize the new products and services that're ready to sell - and that's even before they're released to buyers - it's all fully accountable and done in real time, without using credit and debt.

Designed for exponential scale

With Cloudfunding combining all the various mechanisms, such as advertising and payment processing, which usually operate separately with it own costs attached, it's now all combined into Automated Selling - where sellers can fast track sales with predictability and full selling prices.

Even if sellers use traditional paid advertising to get some exposure to the market, automated selling moves the bulk of the inventory without costs for listing, advertising and payment processing.

DeCom Markets have the grassroots mechanics to automate productivity

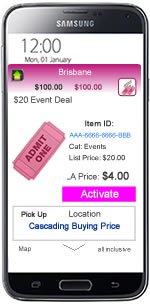

Productivity is the main dynamic by which local economies gain economic wealth through the trading of products and services from the supply side to the demand side of markets - which's where DeCom Markets's disrupt the status quo by shifting productivity from the last step in the financial system's labyrinth of rentier services, to leading catalyst, to directly drive economic wealth and growth into local economies through debt free stimulus - which can be sustained for as long as there's supply looking for demand through the outsourced selling of inventories at full selling prices, and cascading buying prices that give buyers affordability and greater buying power.

The economic value of inventories in local economies is a resource with an intrinsic value that's trackable on a global scale - it's unique in that it can't be manipulated in value ( as in increasing asset prices ), and can be distributed as free working capital across the real local economies around the world - where with deep tracking technology, can capture the aggregate demand of global productivity, and through a recycling mechanism, validate the free working capital into a neutral universally distributed capital - which can then be liquidated into any global currency at local businesses in typical daily sales, without interest or costs, or can be used in peer to peer spending.

This Century's assembly lines will scale productivity through outsourced selling

Just as Henry Ford re-invented the assembly lines in the early car industry, there was a flow-on to all other types of industries that changed how productivity could be expanded with the economic benefit flowing over to the broader communities.

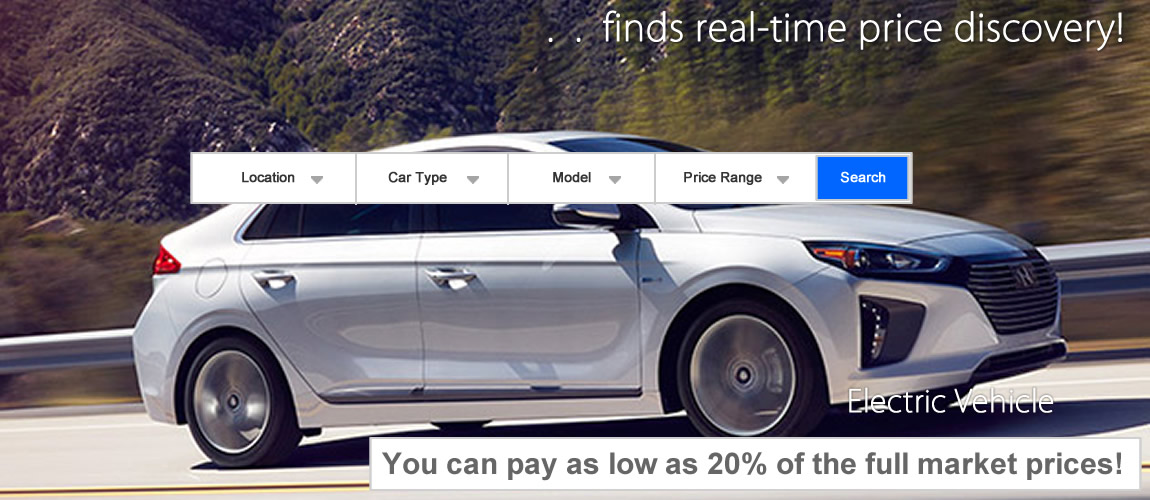

As an example, the decentralized local economic markets could change the Electric Vehicles industry of today, which so far have had limited success in sales, it could have a similar moment as the assembly line did in the early 1900s that resulted in increased productivity - with the economic infrastructure that DeCom Markets operate with, the Electric Vehicle industry could be in the fast lane to scale productivity in the 2020s - with outsourced selling monetizing and guaranteeing full profit sales, while cascading buying prices give buyers the chance to pay prices they want to pay - these are commercial dynamics that can be repeated across businesses and industries big and small to gain and sustain ongoing productivity across local economies.

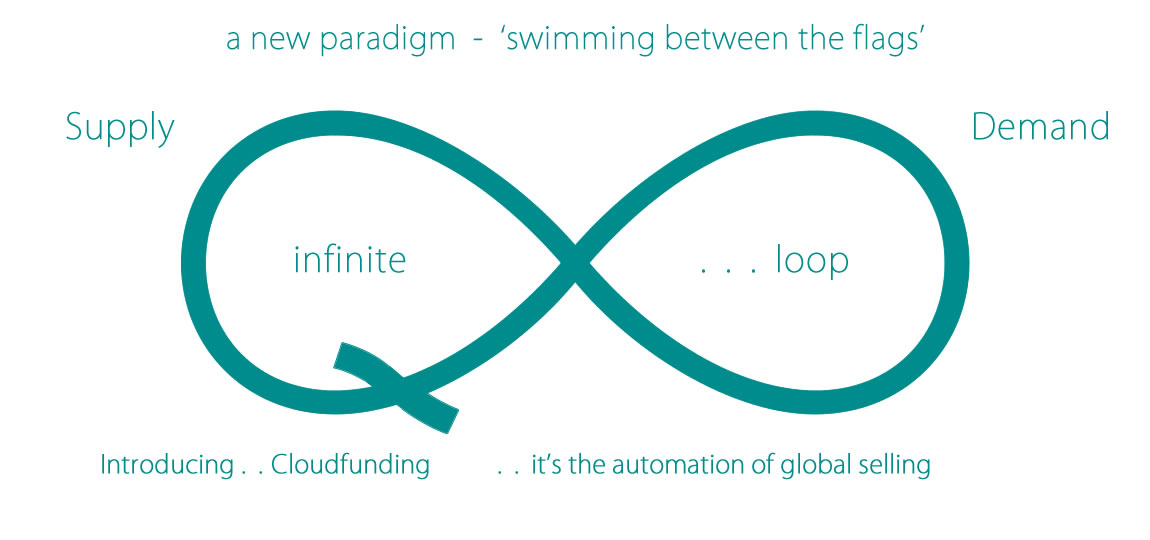

Swimming between the flags

The mechanics between supply and demand have simply been seen as exchanging products and services using a third party value to facilitate an exchange - what technology has given the world is the ability to refine that action between buyers and sellers using the market's economic value of the products and services being exchanged, without any third party or value - what technology can do is track the economic value from when the products and services are ready to be sold by the seller, to when the products and services are sold and passed from the sellers to the buyers, in exchange for the full economic value ownership being released to the sellers - the collecting and distribution of the economic value is through SODA - subliminal organic decentralized advertising, and local Media is able to partner with the DeCom Markets and use SIA - subliminal interactive advertising to increase productivity in their local economies.

The challenge of finding a balance between supply and demand so that there is an ongoing increase of economic growth, has been at odds in the last few years with constant seller discounting, and low wage growth that hasn't kept pace with price increases - what the DeCom Markets overcomes is the lack of profitability for sellers and the affordability for buyers - it's done with technology that separates the supply side of the market from the demand side - in doing so, it allows economic incentives to be simultaneously directed at both sides with stimulus to get the maximum profits for sellers by way of Outsourced Selling, and affordable prices for buyers with Price Demand - technology now can give us deep tracking of global products and services activity that can follow the economic value throughout the journey from the supplier to the consumer - this real time transparency makes it possible for direct economic stimulus to be targeted at both sides of the market in local economies to generate more predictable productivity in an infinite loop of activity - it avoids the rentier and feudal model that the financial markets and systems need to operate with to support their services.

What DeCom Markets do is rebuild localization, so more products are physically built with local labor, instead of relying on outsourcing the manufacturing of products elsewhere using cheaper labour, which is the major obstacle making locally manufactured products uncompetitive - Cloudfunding overcomes that by outsourcing the selling of products ( and services ), which monetizes the locally manufactured products with direct foreign digital capital - DFDC is the validated aggregate demand from global productivity that's recycled back through a distribution mechanism to the global users who initially helped to monetize the inventory - this direct foreign monetization ( are not loans that need to be paid back ) effectively guarantees the full selling prices before the products and services are released to buyers, who then have Price Demand to compete with, and pay prices they can afford, even though the full selling prices maybe higher than the foreign manufactured products - this full monetization from foreign ( and local ) users is the global scale that the Outsourced Selling mechanism operates in - it flips the global commercial landscape around and gives local sellers the competitive advantage over foreign manufactured products by using 'foreign labour', digitally - utilizing the intrinsic economic value, governed by local products and services, as the means of exchange between buyers and sellers, while continually 'swimming between the flags' within the Supply and Demand dynamics, in a new paradigm.

Because the economic value has the intrinsic value of products and services it can't be diluted or speculated with, making it a modern day Gold Standard that's governed by the volume of product and service sales, not only in a single local economy but around the world from economy to economy - its neutral universal trading value is maintained by using the aggregate value of global currencies ( down to 14 decimal point ), making it the most stable ( economic capital ) value capable of flowing across borders, and ubiquitously connecting sellers with buyers in local economies - there are no fees or spreads, and no holding domestically or transferring of any local ( sovereign ) currencies across borders, because the activity of buyers and sellers only operates between and within the supply and demand markets - it's a paradigm shift to 'swimming between the ( supply and demand ) flags', without needing any third party value - it's a peer to peer interaction that passes the ownership of a validated universal economic value between buyers and sellers while trading between local economies, linked together on new highways around the world, without leaving a trail of debt.

The DeCom Markets provide the deleveraging tools and mechanisms for sellers and buyers, in all local economies, to 'swim between the flags', and reduce the reliance on credit and debt - on a scale far greater than what's available to businesses and individuals operating day to day, week to week, obligated and committed to being stuck in a system that's designed to have continual boom and bust cycles.

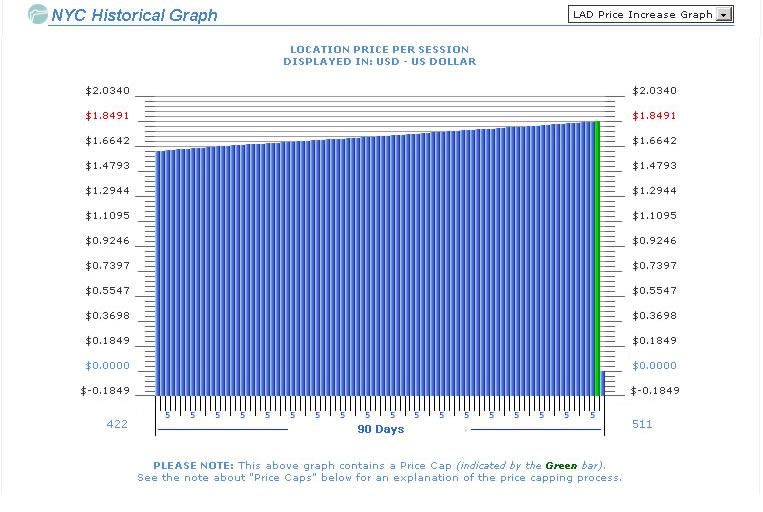

Retractable market dynamics create a new dimension

As more market makers direct their focus on specific locations by helping to drive productivity, and by collecting more units, there's a change in the dynamics with a lower share of the economic equity available - this specific dynamic adds another layer of strategy for market makers to decide whether to increase their direct involvement in generating more productivity in those locations ( if there is any to monetize ), or shift their focus on to other economies - this is when some market makers will liquidate the number of location units they have collected and move to other locations ( contracting that market ), the result means that as units are liquidated they are dissolved, leaving the remaining market makers with a greater share available of the economic equity ( growth ), which they can continue to benefit from as they help drive productivity - this is a change in the way the traditional Balance of Payments are handled with economies by the financial markets and systems at the national level, it brings it down to a decentralized local level that can directly balance the flow of trade and payments in real time by market makers who may reside in a location and join others in an alliance favoring their own local businesses and industries, and even neighboring local economies that they trade with.

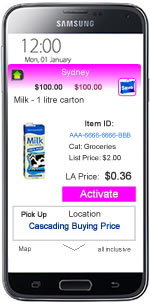

The economic markets operate in real time, which means as market makers drive the local productivity via monetizing the seller's inventory, then waiting for local buyers to use price demand and the cascading buying prices, and trigger the release of the seller's full selling prices and the LAT ( location activity tax ) to complete the real time process, which distributes the increase in the location unit's value to the holders as a universally distributed income - this direct involvement of market makers being pro-active in making individual strategies to generate productivity in economic markets in real time, differs greatly to how financial markets operate.

DeLEconomic Markets are designed to be pro-active

While the financial markets are structured around the share market as the leading indicator of company efficiency and profitability, it relies wholly on investors channeling money into buying shares in companies in return for dividends as well as share prices that rise - the skill of company strategists, analysts and traders has been refined over the time ( since the East Indian Company was formed ), to convince people to hand over money so the companies can expand and be more productive - that formula and ideology has changed over time and skewed the distribution balance to favor those doing the steering and sharing the spoils.

The economic markets have always been around but never modeled, until now, to represent the productivity of local economies, all the way down to the towns, cities, regions and countries - while every economy is different in size, they can all be treated equally in the new economic markets platform by using an open market democratic formula that allows local markets to expand the number of location units available as market makers see the opportunity to help drive productivity in the specific locations through industries and businesses - it's where the market makers use direct strategies to gain the benefit by getting a greater share of the local economic equity that they helped to generate.

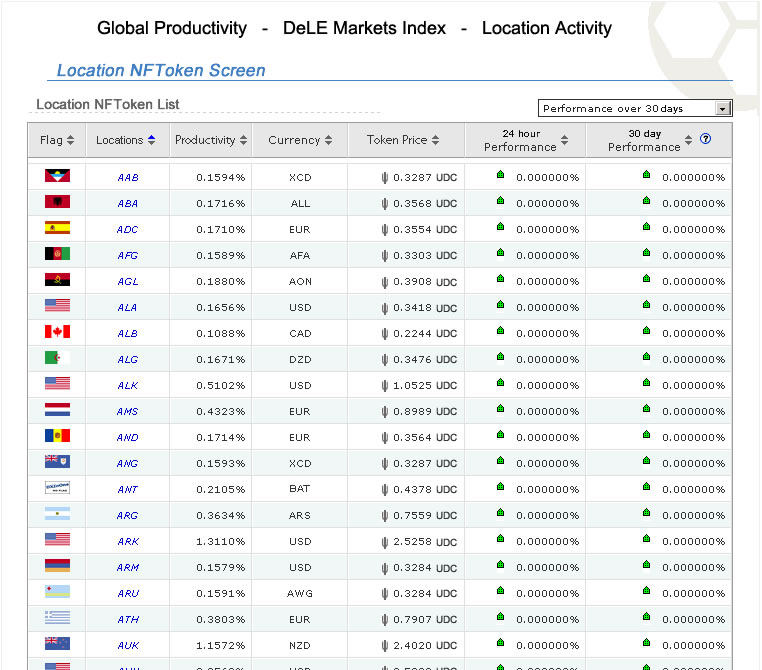

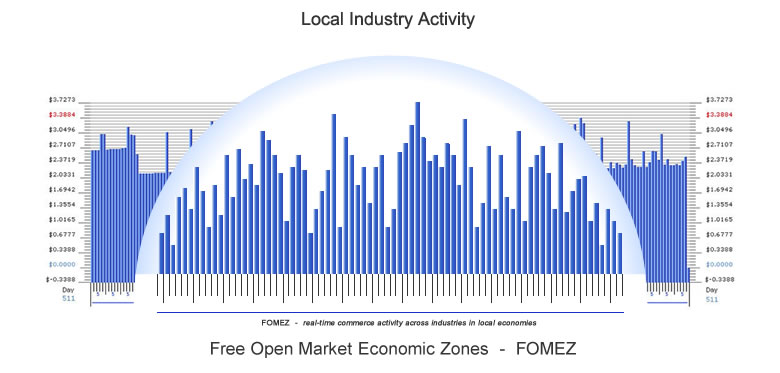

Local activity flows from economy to economy on a global scale

The scale that the Decentralized Local Economic Markets operate in is wider and more directly related to the communities than the way the Financial Markets operate - DeCom Markets has an economic architecture that operates autonomously and independent of the financial system, and has its foundations set in the grassroots environment of Main Street in local economies where SME businesses generate the everyday commercial activity that flows from economy to economy, generating wages that continually flow throughout the communities - at the local level the real time interactions between buyers and sellers are tracked ( not personal surveillance ) as commercial activity, generating profits for the seller in free open market economic zones - FOMEZs - this is the economic activity ( before taxes, wages etc ) recorded in local economies as a Productivity %, which's displayed in real time in the Global Productivity Index ( with thousands more locations to be added ) - from each of these activities there's a location activity tax collected in each local economy that's listed under a Location Token, and this LAT is then equally distributed in real time to the global users who hold the Location units in universally distributed income portfolios - this distribution, which is binary and linear, therefore it can only be positive, maybe zero if there's no activity, but never negative, provides the offset to stagnant wages and price increases while providing the flow-on effect of savings that can be spent into the local economies.

Localization never went away

Local communities, local media and local economies go hand in hand in keeping things ticking along in towns and cities but as globalization threaded its way down into local communities it dissolved much of the local manufacturing and commerce that kept money following within the local economies - so localization needs to be reintroduced but in a way that technology does the hard work - and local Media is still positioned as an important town crier 'connector' in local commerce.

Outsourced Selling supersedes Outsourced Manufacturing

To rebuild localization, where more products are physically built with local labour, instead of relying on outsourcing the manufacturing of products elsewhere using cheaper labour, the major obstacle is obviously the cost of local labour that makes pricing uncompetitive - Cloudfunding overcomes that by outsourcing the selling of products ( and services ), by monetizing the locally manufactured products with direct foreign digital capital - DFDC is the validated aggregate demand from global productivity that's recycled back through a distribution mechanism to the global users, who initially helped to monetize the inventory - this direct foreign monetization ( are not loans that need to be paid back ) effectively guarantees the full selling prices before the products and services are released to buyers, who then have Price Demand to compete with, and pay prices they can afford, even though the full selling prices maybe higher than the foreign manufactured products.

This full monetization from foreign ( and local ) users is the global scale that the Outsourced Selling mechanism operates in - it shifts Productivity from last to be the leading catalyst in Commerce's mechanisms and monetizes it ( Productivity ) so that products and services are 'fully paid for', before they get released to buyers - it flips the global commercial landscape around and gives local sellers the competitive advantage over foreign manufactured products by using 'foreign labour', digitally - utilizing the intrinsic economic value, governed by local products and services, as the means of exchange between buyers and sellers, while continually 'swimming between the flags' within the Supply and Demand dynamics - in a new paradigm - it means that only two components, the Supply side and the Demand side are needed to exchange the economic ( capital ) value between buyers and sellers to complete a trade for products and services, that can be liquidated into local currencies without costs, instead of using a third component offering the use of local currencies with costs - the universal economic capital value generated from productivity, and self governed by its global aggregate demand, is a genuine alternative way to create an international unit of account, compared to the way credit is created out of thin air.

Free Open Market Economic Zones - FOMEZs automatically form as local sellers and buyers trade together, with both taking advantage of the competitive advantage that local sellers have competing for market share - that advantage comes about with a shift in the economic infrastructure model at the local level, one that fully monetizes a seller's products and services before being released to local buyers using an economic engine that incentives global users to participate in 'user friendly' Game Theory and FOMO economics - it's designed to capture the aggregate demand from completed global productivity, and use that economic value to validate and govern the new capital flows ( without incurring debt ) - which's able to exponentially and sustainably monetize an infinite loop for any amount of inventory listed by local sellers - there's a flow-on benefit from maintaining full selling prices, and that's with the full tax revenues that can be gained, instead of it being diluted from seller discounting.

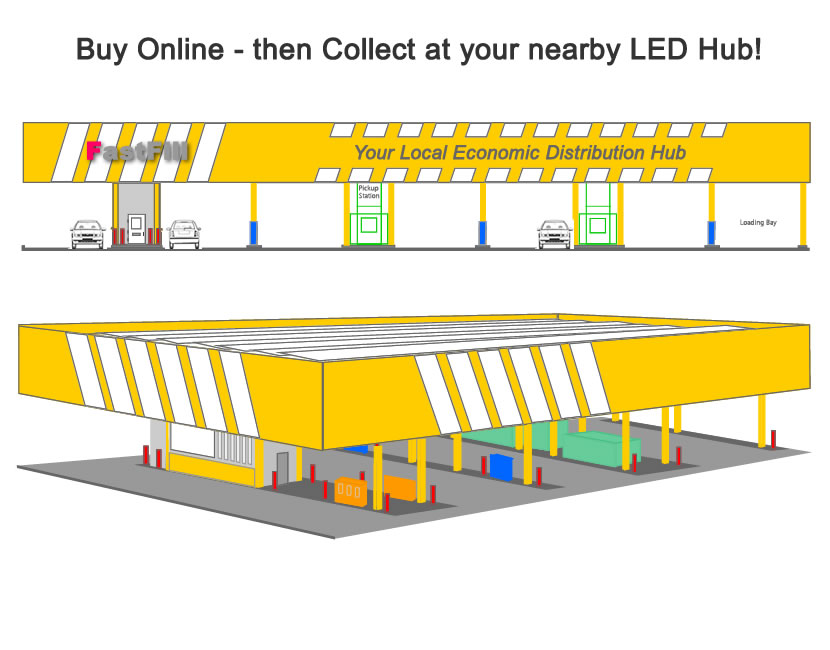

Local Economic Distribution - LED Hubs are a new generation of local economic stimulus that sits between local sellers, who may be located in the central business zones, and buyers who live in outer suburbs, and only occasionally shop in the central city or shopping precincts - it's a local economic hub which can be both a physical B&M or existing businesses connecting sellers with buyers and economies with economies - the inventory held by sellers within most zones has sufficient economic value to exponentially drive an entire local economy on a sustainable path to growth, which can lead to economic flows spilling over into other local regions - it comes down to stimulating trade through incentives that gain velocity in the exchange of economic value, making it profitable and affordable, locally - all of which is tracked in real time by the Global Productivity Index, which helps the market makers direct their efforts into raising productivity in the various local economies - where totally new economic alliances of local economies can be established by local communities.

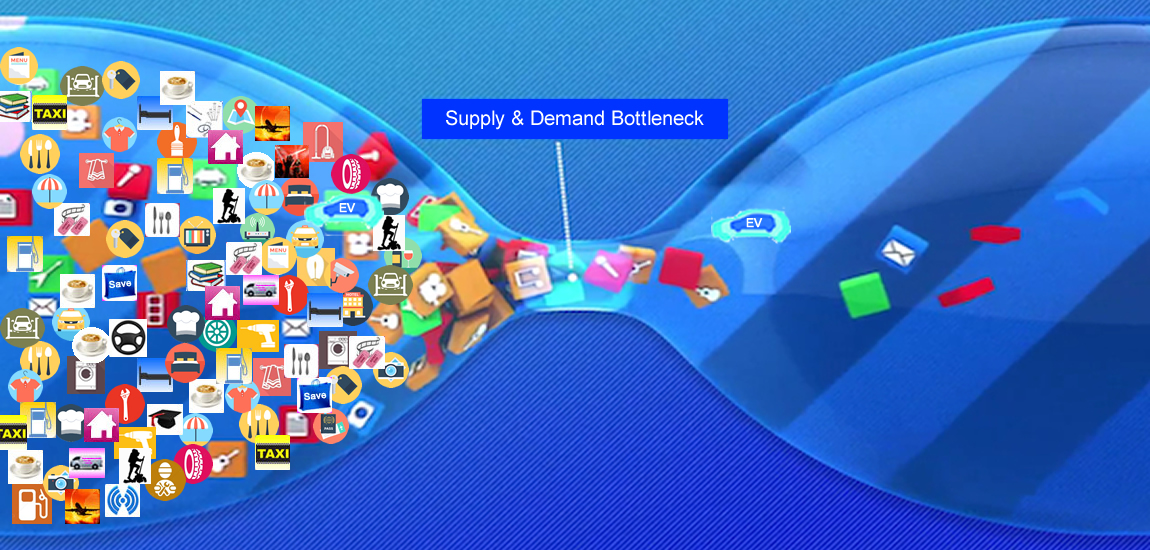

Local economies can avoid bottlenecks in the supply chain

In post COVID-19, the landscape will undoubtedly be different for those businesses that come through and still have inventory, or can get inventory, it will potentially create an 'off the scale bottleneck' between Supply and Demand - because the consumer will be hesitant in spending what limited reserves, and even credit that will be limited ( not forgetting the generational austerity impact ) - there is a brewing dilemma with an over-supply of inventory looking for a limited demand, which will push businesses into discounting to beat the competition for sales ( even more discounting than pre COVID-19 ).

With the volume of economic value sitting in inventories ready to sell in most local economies being greater than the volume of loans and credit that the financial system can release across local communities, there's a good reason to have a decentralized but independent local economic infrastructure that can avoid the looming bottlenecks between the demand side and the supply side of the markets.

Operating in a new paradigm

Just as the world is coming to realize that 'the mechanics' that Commerce has relied on to drive productivity in the past just isn't working anymore - leaving it wide open for a paradigm shift to a new economic infrastructure that directly drives productivity through locations ( localization ) using the untapped 'idle capacity' of inventories waiting to be sold - it's tapped and subliminally distributed via SIA as free working capital to users in local economies using the full selling value of inventory as the leading catalyst to govern the flow - which is then validated by the aggregate demand of the sold inventory ( productivity ) through a recycling mechanism, directing the value back to monetize newly listed inventories.

This mechanism perpetually stimulates the supply and demand markets ( without finance ) in a totally new economic alliance of local communities, including local Media - it's a new narrative being written in how Commerce will operate in this digital century with decentralized local economic markets taking over supply and demand activity, distributing economic growth into local economies that gets tracked in real time by the Global Productivity Index.

Unlike the Financial Markets that relies on money to come from the real economy where working wages are 'clipped' by rentier services to fund share markets for speculative purposes, hoping that some profits trickle back down to the real economy via dividends - DeCom Markets are governed by productivity generated by the demand for supply, without speculation, but with genuine strategies made by a democratic network of global users who are driven by incentives, creating a vibrant ecosystem of fair open market commerce and trade, independent of the financial system.

The real local economies of the world have never had an economic infrastructure that's independent to the control held by the financial system, mainly due to the complexity of implementing an interconnected system that could move and track commerce and trade between sellers and buyers and from economy to economy - that was up until the digital age and the internet, now everything will change and give society the means to use democratic interactions to gain economic wealth that can be fairly distributed.

Economic value is the true value of the real economy

Tapping each local economy's economic value by applying subliminal organic advertising, before validating it as a means of exchange, is a profound difference to the financial system's creation of money to facilitate commerce - in the real economies the economic value is the new economy's foundational value that can't be destroyed or diluted, whereas money created for credit is destroyed when it's repaid to balance the lender's books, which effectively dilutes the local economies of economic wealth when the payments, and additional interest payments, are taken out of the local cashflows ( money supply ) from the real money gained from real productivity ( wages etc ).

In the economic markets ( DeCom Markets's ), as the economic value is validated from the free economic value ( free working capital ) into the neutral universally distributed capital ( by recycling the global aggregate demand of productivity / actual sales ) - it means its value can't be diluted or changed, even when it gets transferred across the world ( without costs ) - it has one important attribute, which is, from its origin, it can be tracked from peer to peer down to 14 decimal points in real time, for security - this means that KYC and AML is paramount in safe-guarding the UDC held by each user, including providing secure escrow tools to safely transfer UDC to other parties - due to the decentralized architecture of the platform, it only needs to track the ownership as the UDC moves between users, which means there is no holding or transferring of any local currencies across borders.

The supply of universally distributed capital held by global users increases organically as more productivity is validated in local economies, and its value remains stable by using the aggregated value of global currencies, which allows it to maintain its neutral position as it integrates across supply and demand in the local economies - the benefit of being uniquely stable against all global currencies, allows asset prices to maintain stability ( without needing to use inflation ), while local currencies fight to hold value against other currencies.

As the world confronts the virus crisis and the flow-on debt crisis, the DeCom Markets have set a 'mark to market pricing' at March 01, 2020, which means that prices of products and services on that date are set as the true economic value that the DeCom Markets allow sellers to operate with - this means the full selling prices of products and services that have been set from that date, and is governed by the Global Price Index that tracks the products and services aggregate demand value in each location, determines if any changes in demand ( higher or lower ) warrants the full selling prices to be held or increased to reflect the demand - this can be anything from a toothbrush to clothing, to cars and houses ( regardless of market crashes ) - Decentralized Local Economic Markets operates much differently from the Financial Markets, specifically due to the economic architecture that uses Productivity's economic value as the leading catalyst instead of credit, which keeps both buyers and sellers debt free when operating on the platform.

This allows sellers, who have built their businesses around the cost of products and services they sell, and still have their ongoing operating costs that will remain at similar prices, to continue to move forward with predictable full selling prices - this means that the economic value of products and services from the set date, is the established value that is used to maintain stability in the DeCom Markets, giving local sellers and buyers an operating economic platform with Outsourced Selling and Price Demand to keep Commerce flowing to help all users, buyers and sellers, to delever from the debt being carried by most businesses and households.

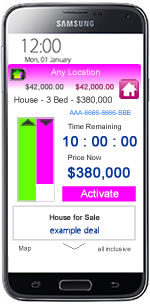

Local Media has a seat at the table with SIA

Subliminal Interactive Advertising - SIA, overcomes the saturation and audience ad fatigue that 'in your face' advertising has been criticized for - SIA does what it says, it operates quietly in the background on mobiles, websites and medium channels along-side content, with only a small logo and a simple Opt-In / Out function, which gives Users the way to automatically hide QwickPic ads ( majority of ads are ignored anyway ) but still have it working in the background - medium channels like television, web and video only need to have the QwickPic logo inserted in the corner of a screen or slotted into newspapers to launch SIA ( siAds is the service used by mediums and sellers ), and viewers and readers only need to spend a few seconds to Opt-In by zooming in to take a snap of the Code - SIA is structured to bring Offline and Online Commerce together on an autonomous economic global platform.

Nuts and Bolts - all roads lead back to local economies

SIA doesn't need to infringe on traditional TV, print or radio advertising - on television it operates during the content time, such as the typical 45 minutes between the 15 minutes of traditional ads shown in every 1 hour of television - what makes SIA different is that once a viewer connects via the siAds logo, as many as 700 plus different QwickPic ads can be distributed subliminally in the background during the 45 minutes via the viewers Online device of mobile or laptop without interrupting the content viewing.

Newspapers and Radio work similarly with daily Codes ( in 24 hr windows ) being placed in the Newspapers or spoken over the Radio, maybe during news time - with newspapers just one siAd logo or radio siAd code could be equivalent to weeks of paid advertising due to the backend connections that readers and listeners have.

It's not just the 700 plus different products and services but the depth in the number of units in the inventories behind the initial QwickPic ads, which could be 1,000 cars or 10,000 holiday rooms, or 100,000 cinema tickets - it could even be back along the supply chains where viewers could engage with the local dairy industry in a direct market-based solution to help monetize farmgate milk prices, and then get another advantage at the local retail end - even take the coffee industry where a local coffee outlet or a group of coffee houses collaborate to have a million cups of coffee processed and released to the communities, or a single or a group of fuel outlets across several cities combine to release millions of litres of petrol - or having more affordable rents / leases and mortgage payments and utility bill payments processed and released as service deals in the 000s - each industry group can use SIA connected via the local Media to stimulate their local economies, no matter where the businesses or consumers are located - all products and services are monetized by the global crowd and governed by the validated aggregate demand of global productivity, before being released with Price Demand for users to pay what they can afford.

Seller discounting is the most damaging thing in local economies

The obvious strategy sellers use when demand is slow is to discount, and when enough sellers do it on mass it shifts control to the demand side - this is where buyers become subconsciously aware that sometimes holding out a bit longer to buy there might even be deeper discounts but even more importantly that things may not good in the economy so the buyers decide to save their money - most thinking is that when a small number of sellers discount stock it's a reaction to the free market, but more often than not it comes down to the disposable and discretionary incomes of buyers - but when there's a mass number of sellers discounting at just 30% discount, this is enough to send a local economy into long term decline - this is where by shifting the control of discounting to the buyers with price demand, changes the dynamics between supply and demand - and giving sellers the chance to outsource the selling, it places sellers in a stronger position where they retain the profits ( and jobs ) and sustains productivity.

Financial Markets are for speculation - Economic Markets are for productivity

Economic value is not the same as credit, which's created by the banking system where the game there is played between the price of credit ( using interest rates ) and the quantity of ( easy or limited ) credit - whereas economic value is an existing resource ( inventories ) that's tapped and distributed to global users and communities as free working capital to directly stimulate the selling and buying of products and services, . . it's free to collect, has no interest or fees, and never needs to be paid back, ever!

Decentralized local economic markets have a democratic process that involves the inclusion of any user, from any society, free access to gaining a share of ( economic ) wealth in their own local economy, and in others, without the draconian 'cost of entry' enforced by the financial markets - these new market makers take over the role of traders that oversee share buys and sells in the financial system's share market - and instead the open market makers directly drive productivity in local economies by fully monetizing inventories as an independent and decentralized global network member operating within an autonomous economic market system, which avoids the manipulation that the financial markets have created for themselves.

The fundamental difference between the financial markets and economic markets is that value is treated differently - the financial markets are centrally controlled markets that sell the future's productivity gains, regardless if there is any, and shares those rentier gains now, but only amongst a few - whereas the economic markets have a decentralized design with a democratic architecture that stimulates an existing economic value, and shares the genuine productive gains in real time with the many.

The economical market takes a different path by shifting to decentralized competition between markets ( by way of independent market makers instead of traders influencing investors ) making it more beneficial to more people due to more transparency - and by having this broader decentralized balance of payments generating greater flows of capital between economies, there's a better balance of economical growth across many more local economies, directly affecting Main Street and local communities - it's directly focused on localization and the grassroots communities that handle much of the supply and demand markets in the local economies!

Main Street now has a sustainable cashflow model

Main Street is the traditional center of local Commerce - and now Cloudfunding is delivering a new era in selling for Main Street!

Local Main Street sellers now have the competitive advantage from technology to finally get the benefits of what the Internet promised.

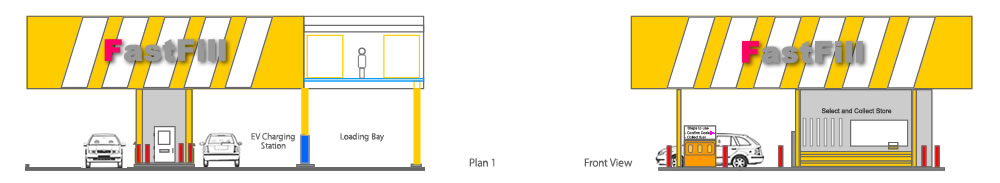

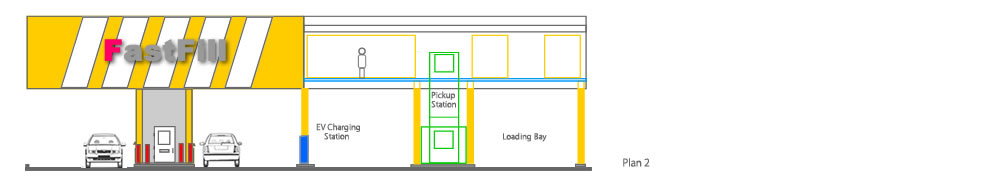

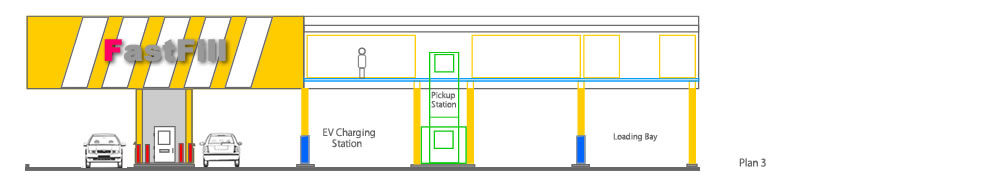

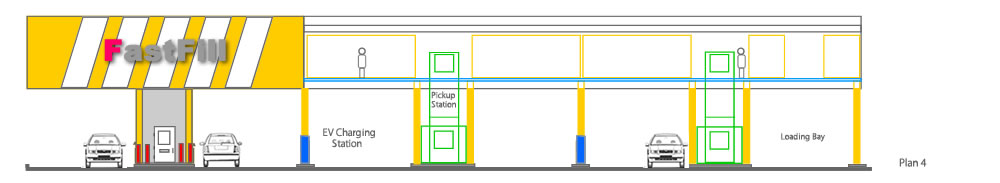

LED - Local Economic Distribution Hubs are an on-the-ground outlet that uses the dynamics of Cloudfunding to give local sellers and buyers the ultimate in competitive pricing, with the convenience of free local pickup and delivery 24/7 - LED Hubs are designed to increase the velocity of Commerce between local sellers and buyers, and so raise the local economic outlook for everyone.

What LED Hubs do is provide Cloudfunding economics for local Commerce to have a direct action point for increasing productivity output in a city, state or country without relying on authorities from above - the trickle down approach in economics has been little more than a 'wait and see, it'll come' waiting for wages to rise - local economies need new strategies where interaction with other local economies can feed off each other to build out a sustainable long-tail economy to economy ecosystem - e2eCommerce.

LED Hubs sit between local sellers that may be located in the central business zones and buyers who live in outer suburbs and only occasionally shop in the central city or shopping precincts - the inventory held by sellers within zones has sufficient economic value to exponentially drive an entire local economy on a sustainable path to growth that leads to economic flows over into other local regions.

Free Open Market Economic Zones - FOMEZs automatically form as local sellers and buyers trade together, with both taking advantage of the competitive advantage that sellers have competing for market share - that advantage comes about with a shift in the economic infrastructure model at the local level, one that fully monetizes a seller's products and services before being released to local buyers - it's done by integrating a collected value ( activity tax ) from previous global productivity, which's able to exponentially and sustainably monetize an infinite loop for any amount of inventory listed by sellers.

Exponential, predictable and sustainable sales

Cloudfunding gives local sellers the environment where they can sell inventory in greater volumes at predictable full selling prices at a faster turn-around rate than traditional selling - and local buyers have more incentive to buy with Price Demand that allows buyers to pay prices they want to pay - for Sellers of pizzas to fashion to cars, the sales volume can exponentially increase and be sustained with real time reconciliation which avoids needing credit terms - Cloudfunding integrates a free peer to peer exchange of local fiat currencies with a neutral internationally tracked trading unit of account to securely exchange the Ownership of products and services in real time, without holding or transferring any local currencies across borders - Cloudfunding breaks down the financial inclusion barriers by decentralizing control over Capital flows across economies using a global consensus.

Cloudfunding gives the overall community the means of being proactive within their own local economy, and get a direct benefit without the waiting - instead of shareholders benefiting via dividends from a company's profits before employees, Cloudfunding breaks down the hierarchy in the economic model and gives the individual user the means of gaining financially from the various number of local companies selling products and services within an economy via Outsourced Selling, Price Demand and UDI portfolios.

The Digital Cash Economy is ubiquitous across local economies

The fluency of the process from the seller listing the inventory to the payment by the buyer breaks the complicated processes inflicted by early adoption of credit and debit cards in online commerce - Cloudfunding brings free Online Cash Commerce into the mainstream by digitizing traditional cash payments, just the same type as traditional cash exchanges are without fees - no more costly cards or interest payments, just simple ubiquitous free payments from a mobile - but with high end level security and tracking, which has shown to be the Achilles Heel of the card providers process - now with free Cashless QwickP2P's peer to peer universal exchange it's so simple to exchange any size purchase seamlessly across borders and economies without delays or costs.

The paradigm shift comes in reversing how incumbents have been able to extract local capital flows from local economies by centralizing control of the money supply via credit and debt - Cloudfunding decentralizes that control by keeping capital flowing within local economies, and increases it with Direct Foreign Decentralized Capital from other local economies around the world - this is where the local Chamber of Economies comes to the fore as part of the Global Chamber of Economies where productivity trends can be tracked.

One day turn-around

The day of receiving stock and selling overnight will become the new norm for sellers that adapt to the new frontier in retailing with Outsourced Selling and Price Demand - sellers will only need to be concerned with restocking supplies and customer service, and leaving the sales to the autonomous selling or even becoming pro-active by engaging with sales from their own Digital Sales Division.

LED Hubs allow sellers to store and deliver inventory midway between themselves and local buyers, bringing together the Offline to Online O2O connection - Cloudfunding's backend economics disrupt the traditional parity in the asking and paying prices between buyers and sellers, essentially by separating the Supply from the Demand, removing the barriers to scale indefinitely as sell high and buy low economy - LED Hubs operate with a free neutral O2O mechanism between Supply and Demand to make it ubiquitous across all market sectors.

LED Hubs stimulate local economies by distributing Cloud Capital / free working capital into the hands of global users - the working capital is 'spent' in strategies by the Global Crowd which directs value from around the world to fully monetize seller inventories, for free, using Direct Foreign Decentralized Capital - DFDC uses an unique global tracking system that's able to transfer value from one economy to another without holding or transferring any local currencies - DFDC drives a new linear business model into local economies without incurring debt.

Offline and Online worlds both have different mechanics and limitations that each needs to absorb into their operating costs - this is where LED - Local Economic Distribution Hubs are designed to merge Offline and Online worlds into seamless O2O Commerce.

Direct Market productivity

Every User can get involved in the productivity side that can influence trade by being an OMM - Open Market Maker - OMM's are market makers that passively participate in driving trade for the Sellers through to the eventual Buyers - Direct Market provides direct access to local economic growth from the Productivity for Users to benefit from their local businesses with the sales they make with other local and global Buyers

- plus as an OMM you're a business entity that doesn't handle any stock or deal with any customers, it's the simple process of using Cloud Capital / FEV / Cloudfunds that are earned for free, and using them to set strategies, then add a bid or be eliminated when it's needed - winning deals earn a profit margin for the OMMs that most businesses could never achieve but one of the main outcomes of the Game Theory bidding process is to validate Cloudfunds into Universally Decentralized Capital using a decentralized and democratic global system.

-

-

-

-

-

-

-

-

-

-

-

-

Cloudfunding merges in-store showrooming with real-time Online Demand

Cloudfunding and LED Hubs give local sellers the advantage of inviting buyers to come in-store, like showrooming where buyers check in-store prices before going online and maybe buying somewhere else - now there's real time Price Demand - it gives local sellers a competitive advantage with predictable and guaranteed sales without the in-your-face targeted advertising and discounting

Cloudfunding operates with Subliminal Organically Decentralized Advertising to distribute the full market value of each product and service on a global scale, at no cost to sellers or buyers - regardless if it's a take-away pizza, shoes, hotel room, taxi fare, a car or even a house, Cloudfunding gives the freedom for sellers to control how they sell at guaranteed full selling prices - and buyers control what price they want to pay with Price Demand, which provides the market analysis that determines price increases or decreases via the Global Price Index - GPI.

Cloudfunding brings a new experience to buyers and sellers with P2P payments using Universally Decentralized Capital - the interaction starts between buyers and sellers paying with Cash - when sellers want to liquidate the sales in their own store, they simply list the amount in their Business Console and exchange the Universally Decentralized Capital ( UDC ) for local Cash with local buyers wanting to fund their accounts, or exchange at another store or at a LED Hub.

Cloudfunding has a positive effect between economies that takes advantage of economies of scale to virally expand the validation of the Universally Decentralized Capital.

The change to how Capital flows from economy to economy with Cloudfunding opens up new ways that businesses and entrepreneurs can gain backing for their ventures or expansions - Free Direct Backing offers just as it says, free direct backing without having to put up equity or pay back loans or interest - FDB is linked directly to DFDC where anyone can directly back a worthwhile venture that has a direct benefit in increasing productivity.

Cloudfunding operates all along the Supply Chain

Supply Chains in B2B and B2C markets are streamlined to leap past CRM, banking and fintech enterprises and third party incumbents by taking advantage of RingLink technology and e2eCommerce - it starts with sellers just listing their inventory to Outsourced Selling and then set the time to release the deals to the local buyers, leaving Price Demand to take care of the final sales.

Cloudfunding addresses the growing issue of predatory pricing and actions by third-party incumbents that build digital walls to limit any fair competitiveness between sellers - Cloudfunding uses Subliminal Organically Decentralized Advertising, a free service that distributes the exposure of a seller's inventory on a global scale.

Cloudfunding is the economic infrastructure that levels the playing field in all markets for Offline and Online Commerce - it brings a scalable and sustainable New Economy to local economies by bringing affordable products and services to local buyers.

Having more affordable prices for products is not complete without the transport and delivery cost being free - a new Freight and Delivery Service industry platform called FreDel Tech brings a new perspective to an industry that moves the economic value between Sellers and Buyers.

Supply chain industries such as Dairy can move Farmgate milk all the way through the supply chain from Farm to Processors to Retail to the Consumer using Cloudfunding - each stage along the supply line there is bargaining power equally balanced with Farmers getting higher farmgate prices ( set to local production costs with profits, and linked to scale as global prices rise ) - while Processors and Retailers compete daily for product on the Domestic Open Market Xchange Trading Platform - DOMIndex.

The simple steps to using LED Hubs

Regional sellers list inventory to Outsourced Selling, adding free home delivery from their store or to pickup at a nearby LED Hub.

Inventory can be delivered by sellers to the LED Hubs using free delivery, ready for pickup by Online buyers.

Buyers can see the products in-store and go Online to buy either with delivery from the store or pickup from a nearby LED Hub.

Each LED Hub is established with its own unique Location Token - the productivity between sellers and buyers flowing through its operations is tracked as part of the Global Chamber of Economies.

There are several levels that users can be involved with in establishing LED Hubs that can be local or even somewhere else - teams and Co-Operatives can be established to earn from the local economy by being pro-active as part of the Global Crowd that drives the Outsourced Selling of products and services in the various economies.

LED Hubs solve the 'last mile delivery' for Sellers

Local sellers list the inventory they want to sell, and decide if the pickup will be at their store or at LED Hubs - there're no storage or selling costs, even delivery from store to LED Hubs or home delivered is free within FOMEZs, it's more about convenience for buyers.

Unlike traditional commerce that operates mostly on credit and terms, LED Hubs operate only on cash terms - as deals are sold with Price Demand, payments are released directly to seller accounts - achieving a much faster turnover of stock and cashflow.

Collaboration between local sellers can continually influence local markets and economies via a higher velocity in trading products and services at full margins - streamlining the flow between supply and demand that's debt free with real-time sales and payments.

Local sellers can join others across various industries in directly establishing Local Economic Distribution Hubs and get direct ROI from sales moving through the local economy - LED Hubs merge local productivity seamlessly across the Global Chamber of Economies.

Local business ventures can now get Free Direct Backing

As with all businesses, there are times when expansion to grow is essential - Free Direct Backing can be used by local businesses to get the support they need to expand their business from a global crowd.

While Cloudfunding helps sellers to outsource the selling of their products, LED Hubs solve the 'last mile delivery' - Free Direct Backing offers businesses with a way to get backing for their business expansion without needing collateral or giving up equity.

To help sellers track all their product movements and sales, the Digital Sales Division - DSD is available to build out the business into the New Digital Economy.

Contact

Privacy Policy

Terms of Service